Will there be an old age pension in Australia when I retire? April 5th, 2023

Ever wondered if you’ll ever have enough money to retire with ?

Here’s some cold hard facts the investment companies and super funds don’t want you to know.

“There won’t be a pension by the time you retire”, and "Will the old age pension stop in Australia?"

These statements and questions are often used by those trying to sell you a supposedly high paying investment or to suck you into pouring more money into super.

In both cases, your motivation is fear that you won’t have enough and their motivation is the hefty fees they’ll collect for managing your investments.

Yes, it even applies to the “low-cost” super funds. With average fees on super at around the 1 percent per annum level, every extra $100,000 you invest translates to an extra $1,000 a year in revenue.

Multiply that by a hundred thousand members or more, and you soon get a sense of how much of an incentive there is to get you sinking more into the retirement kitty.

There’s nothing wrong with having plenty of money saved or invested for your future. It probably gives you more choice than the next person. Choices like retiring early or flying up the at the luxury end of the plane when you travel.

The point is, forcing yourself into a reduced lifestyle now and taking excessive risk in order to get to the magic million, is never a good idea. It usually translates to more angst and sleepless nights as you try to juggle your savings and worry when investment markets take an inevitable hit.

And that assumes, you’re not involved in a high-returns investment that you don’t really understand and isn’t really, some form of scam.

The Australian Retirement Income System

Let’s start with the Australian retirement income system, ranked number 6 in the world on the Global Pension index.

We used to enjoy the number 4 spot until a few years ago, but Covid inspired raids on super haven’t helped our cause.

On a reasonably regular basis, the boffins in Treasury, run the numbers on how things are playing out for the long-term.

Called the “Intergenerational Report”, the most recent version was published in 2021.

While this is heavy going at 180 pages, the future doesn’t look quite as bleak as those trying to flog you an investment property in rural Queensland, would have you think.

Fast-track your way to page 111 and you get to the juicy-bits to discover the following:

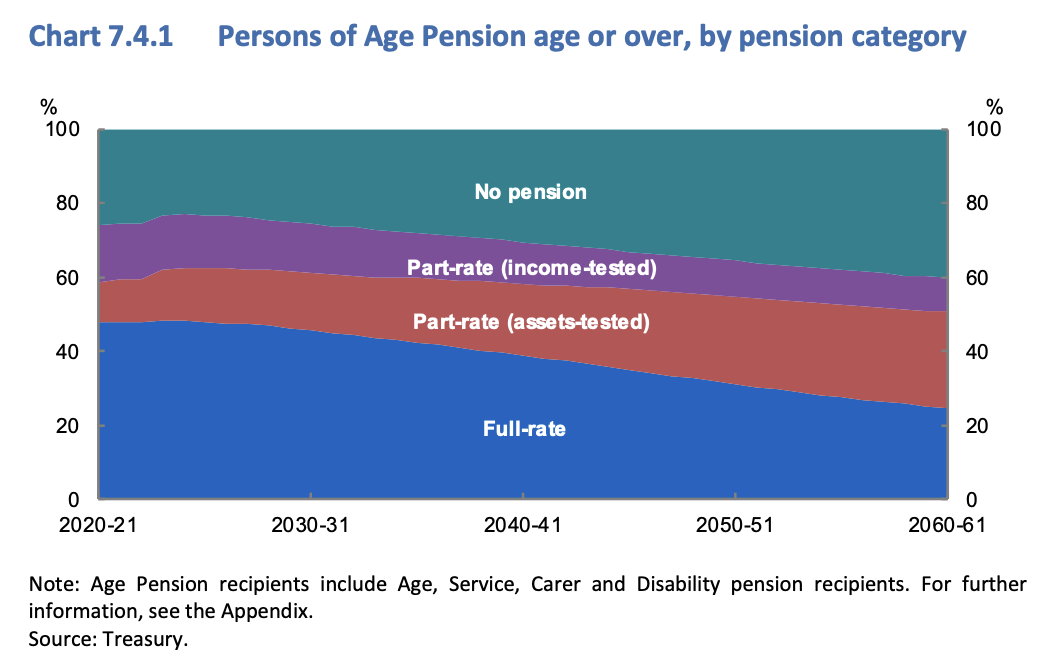

What we see here, is that the proportion of Aussies receiving a full rate of age pension declines quite dramatically. From nearly 50 percent now, to about 24 percent by 2060, however the portion receiving a part-pension increases.

And that is the magic of the means-tested pension system coming into play.

Our retirement income means-test system applies the principle that if you have the means to either fully or partially fund your own retirement, you’re forced to do so.

As a percentage of Australia’s “annual income”, as represented by Gross Domestic Product or GDP the following chart from the report shows that in fact, the pension impost on your grand-kids actually declines over time.

Yes, you’re reading it correctly. What currently sits at about 2.5 percent of GDP drops to about 2.3 percent of GDP.

The application of our compulsory superannuation system virtually guarantees that most retirees in the future won’t receive a full age pension, and that's by design.

An Example

Let’s take a real example. A 20 year starting out today on a salary of $90,000 that simply increases by CPI and receives 12 percent compulsory super (which is where it will be in 2025) retires at the current pension age of 67 with nearly $1.7 Million, assuming a modest average earnings rate of 6 percent over the period.

Now with inflation you might think that much money will only buy you a week’s worth of groceries in 2070? In fact, it is the equivalent of having $532,000 today.

A home-owning couple retiring with this amount each, would not qualify for a part-pension at retirement age, but will by the time they hit their mid-to-late 70’s. They would be generating a tax-free retirement income of about $53,000 at retirement but would be receiving their medicines for $7.30 a script and a raft of other discounts and concessions.

A home-owning single on the other hand, qualifies for a part pension of about $220 per fortnight and an income from the super savings of about $27,000 per year along with the same discounts as our couple. All up, about $33,000 per annum.

In this scenario, they will probably be forced to spend more of their money in the early years of retirement.

In both cases however, as they spend more, the rate of age pension increases as the means-test effects diminish.

Incredibly, the “sweet-spot” for a home-owning couple at the moment, is around about $380,000 combined in super and savings. That generates a tax-free income of about $61,000 per annum, again with all the discounts which can be calculated to be worth around $7,000 per annum.

There will be a retirement system when you retire

Recent years have undoubtedly been filled with multiple "once-in-a-lifetime" events, but the Australian retirement income system has been designed well. With a decreasing reliance on the welfare system and increasing reliance on the superannuation that you earn throughout your working career.

At Netplan we show you how to plan for a realistic retirement, without the stress and without flogging you investments or new super funds.